Introducing Zelle®3 – a fast, convenient and easy way to send money to friends, family and other people you trust1, regardless of where they bank. Whether you’re paying rent, gifting money, or splitting the cost of a bill, Zelle® has you covered.

FAST

Send money directly from your account to theirs — typically in minutes1.

CONVENIENT

Find Zelle® within the Alpine Bank mobile app or online banking.

Easy

Send money using just an email address or U.S. mobile number.

Zelle® Frequently Asked Questions

{beginAccordion}

What is Zelle®?

Zelle® is a fast, convenient and easy way to send money directly between almost any bank or credit union account in the U.S., typically within minutes1. With just an email address or U.S. mobile phone number, you can send money to people you trust, regardless of where they bank1.

How do I use Zelle®?

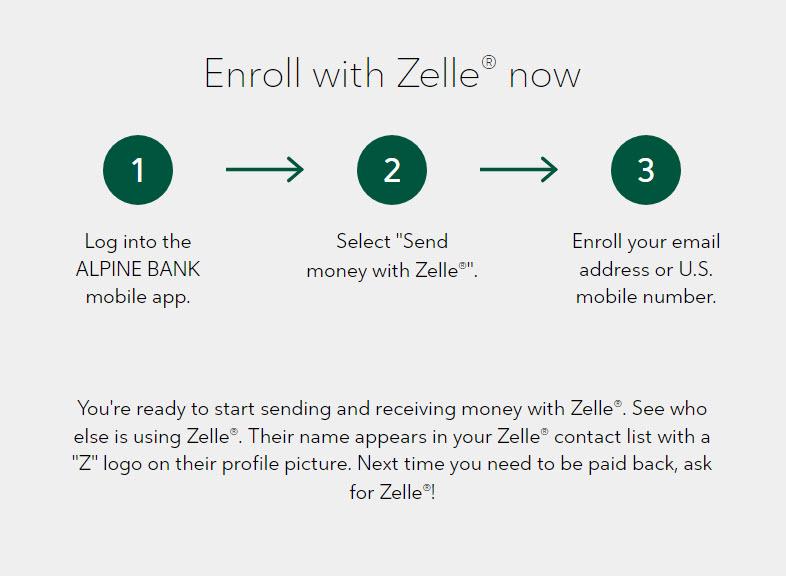

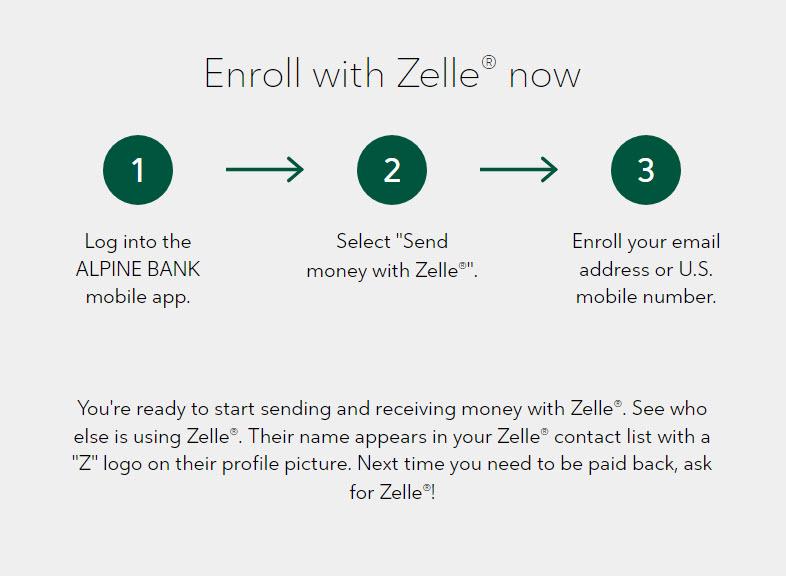

You can send, request, or receive money with Zelle®. To get started, log into Alpine Bank's mobile app and select “Send Money with Zelle®”. Following the prompts, enter the information requested, accept the terms and conditions, and you’re ready to start sending and receiving with Zelle®.

To send money using Zelle®, simply select someone from your mobile device’s contacts (or add a trusted recipient’s email address or U.S. mobile phone number), add the amount you’d like to send and an optional note, review, then hit “Send.” In most cases, the money is available to your recipient in minutes1.

To request money using Zelle®, choose “Request,” select the individual from whom you’d like to request money, enter the amount you’d like to request, include an optional note, review and hit “Request”2. If the person you are requesting money from is not yet enrolled with Zelle®, you must use their email address to request money. If the person has enrolled their U.S. mobile number, then you can send the request using their mobile phone number.

To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle®. If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your Alpine Bank account, typically within minutes1.

How do I get started?

It’s easy — Zelle® is already available within the Alpine Bank mobile app! Check our app and follow a few simple steps to enroll with Zelle® today.

What if I get an error message when I try to enroll an email address or U.S. mobile number?

Your email address or U.S. mobile phone number may already be enrolled with Zelle® at another bank or credit union. Call our customer support team at 800-551-6098 and ask them to move your email address or U.S. mobile phone number to Alpine Bank so you can use it for Zelle®.

Once customer support moves your email address or U.S. mobile phone number, it will be connected to your Alpine Bank account so you can start sending and receiving money with Zelle® through the Alpine Bank mobile app. Please call Alpine Bank customer support toll-free at 800-551-6098 for help.

How does Zelle® work?

When you enroll with Zelle® through your Alpine Bank app, your name, the name of your bank/credit union, and the email address or U.S. mobile number you enrolled is shared with Zelle® (no sensitive account details are shared – those stay with Alpine Bank). When someone sends money to your enrolled email address or U.S. mobile phone number, Zelle® looks up the email address or mobile number in its “directory” and notifies Alpine Bank of the incoming payment. Alpine Bank then directs the payment into your Alpine Bank account, all while keeping your sensitive account details private.

Who can I send money to with Zelle®?

You can send money to friends, family and others you trust1 even if they have a different bank or credit union.

Since money is sent directly from your Alpine Bank account to another person’s bank account within minutes1, it’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile phone number.

I’m unsure about using Zelle® to pay someone I don’t know. What should I do?

If you don’t know the person, or aren’t sure you will get what you paid for (for example, items bought from an online bidding or sales site), you should not use Zelle®.

These transactions are potentially high risk (just like sending cash to a person you don’t know is high risk). Neither Alpine Bank nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

What types of payments can I make with Zelle®?

Zelle® is a great way to send money to friends, family and people you are familiar with such as your personal trainer, babysitter or neighbor1.

Since money is sent directly from your Alpine Bank account to another person’s bank account within minutes1, Zelle® should only be used to send money to friends, family and others you trust.

Neither Alpine Bank nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

Can I pay a small business with Zelle®?

Some small businesses are able to receive payments with Zelle®. Ask your favorite small business if they accept payments with Zelle®. If they do, you can pay them directly from your Alpine Bank mobile app using just their email address or U.S. mobile number.

Neither Alpine Bank nor Zelle® offers a protection program for any authorized payments made with Zelle®, so you should only send money to people (and small businesses) you trust. Also, always ensure you’ve used the correct email address or U.S. mobile number when sending money.

Can I use Zelle® internationally?

In order to use Zelle®, the sender and recipient’s bank or credit union accounts must be based in the U.S.

Can I cancel a payment?

You can only cancel a payment if the person you sent money to hasn’t yet enrolled with Zelle®. To check whether the payment is still pending because the recipient hasn’t yet enrolled, you can go to your activity page, choose the payment you want to cancel, and then select “Cancel This Payment.” If you do not see this option available, please contact our customer support team at 800-551-6098 for assistance with canceling the pending payment.

If the person you sent money to has already enrolled with Zelle®, the money is sent directly to their bank account and cannot be canceled. This is why it’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

If you sent money to the wrong person, please immediately call our customer support team at 800-551-6098 so we can help you.

What if I want to send money to someone whose bank or credit union doesn’t offer Zelle®?

As of March 31, 2025, all users must be enrolled through one of the more than 2,200 banks and credit unions that offer Zelle® in order to send and receive money. The list of participating financial institutions is always growing. You can find the updated list of participating banks and credit unions live with Zelle® at Zellepay.com. If their bank or credit union is not listed, we recommend you use another payment method at this time.

Someone sent me money with Zelle®, how do I receive it?

If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your Alpine Bank account, typically within minutes1.

If you have not yet enrolled with Zelle®, follow these steps:

- Click on the link provided in the payment notification you received via email or text message.

- Select Alpine Bank.

- Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile phone number where you received the payment notification - you should enroll with Zelle® using that email address or U.S. mobile phone number to ensure you receive your money.

How long does it take to receive money with Zelle®?

Money sent with Zelle® is typically available to an enrolled recipient within minutes.

If you send money to someone who isn’t enrolled with Zelle®, they will receive a notification prompting them to enroll. After enrollment, the money will be sent directly to your recipient’s account, typically within minutes.

If your payment is pending, we recommend confirming that the person you sent money to has enrolled with Zelle® and that you entered the correct email address or U.S. mobile phone number.

If you’re waiting to receive money, you should check to see if you’ve received a payment notification via email or text message. If you haven’t received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or U.S. mobile phone number.

Still having trouble? Please give the Alpine Bank customer support team a call toll-free at 800-551-6098.

{endAccordion}

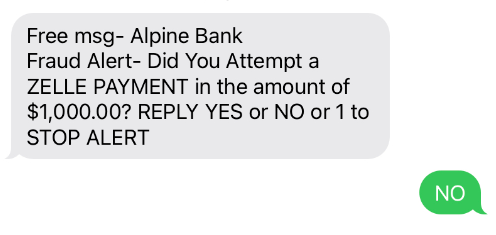

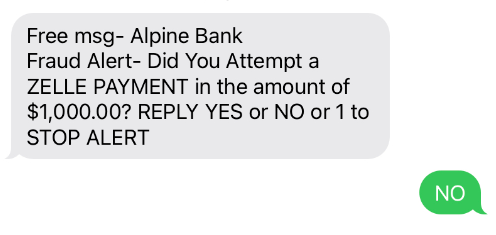

Don’t be a victim!

A scam currently circulating nationwide involves customers receiving a fraudulent text message alerting them of a Zelle® payment and asking for a yes or no confirmation. Upon confirmation, the fraudster will initiate a phone call to the customer posing as the bank, and will then attempt to obtain sensitive account information. Please know that Alpine Bank nor Zelle® will never contact you and ask for sensitive account information, including your username, password, or one-time codes. If you should receive this type of message, delete it and contact your bank directly.

1 U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes and generally do not incur transaction fees.

2 In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already enrolled with Zelle®.

3Must be at least 13 years of age. Please refer to product terms and conditions.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.